How does your company deal with late payers?

Wise men say that the outlook in the world economy might not be as bleak as it was. That being said, a lot of companies are still struggling with bad or late payers. This forces companies through time- and resource-consuming processes in their debt collection. In the worst case, this may affect the employees’ focus of providing the best possible service to the customers, who actually pay their invoices in due time.

Does this problem sound familiar? If so, it might be a good idea once and for all to get an overview of the rules of debt collection and maybe even to create an effective internal procedure on when and how to react against late payers. Because no one wants to spend too much valuable time and energy on making their customers pay.

Through the legislation on debt collection, the Danish government has tried to compensate for the companies’ extra costs by allowing them to charge various fees and interests during the different steps of the debt collection procedure. However, this most often only brings a minor consolation and the modest-sized fees rarely cover the companies’ actual expenses. On top of this, the legislation consists of a maze of intricate rules for the companies to navigate in; rules that are able to put most people out of breath.

But don’t worry; we have prepared this mini guide to give your company the necessary overview of the Danish legislation on debt collection, and thus providing you with the tools to either determine a new internal procedure on debt collection or perhaps amending the existing procedure.

Debt collection – step by step

Before deciding on the procedure best fit for your particular company, it is important to know the rules on debt collection. The procedure of debt collection may be launched as soon as the company realizes that a debtor (often a customer) has not paid an invoice by the time the deadline expires. A collection procedure usually follows these three main steps:

- When the deadline of payment has expired, the company must send one, two or three demands for payment; the last demand including a notice of debt collection

- The company must send an information letter stating that the claim has now been assigned to debt collection

- Finally, a simplified legal action can be instituted

All companies decide for themselves how many warnings – i.e. demands for payments – should be sent; one, two or three. In the end, this is a question of how long a leash the company wishes to give the debtor. However, there are two conditions that needs to be followed: a) There has to be at least 10 days between demands for payment, and b) the final demand must contain a notice of debt collection letting the debtor know that if payment has not taken place 10 days after the date of the notice, the debt will be assigned to an actual debt collection procedure.

At this point the company has the right to start the actual debt collection. The company is obliged to inform the debtor that such assignment has taken place, and the debtor must be given a warning that legal action might be instituted if the full amount is not paid within an additional given period of time of at least 10 days.

If the debtor has still not paid by the time the additional deadline expires the enforcement court may be involved.

When a company asks for the assistance of the enforcement court it submits a so-called small money claim form. The form can be found at www.domstol.dk – Selvbetjening – Blanketter – inkasso – Betalingspåkrav.

With an efficient collection procedure, the form can usually be submitted to the court 50-60 days after the original time of payment.

It is for the companies themselves to determine, whether the debt collection should be assigned for external debt collection performed by an attorney or a debt-collection agency or, whether the company prefers to handle the collection in-house. Many companies choose a combination; they handle the demands for payment themselves but leave the actual debt collection to an external adviser.

Fees and interests

Okay, so far so good. But how much is a company entitled to charge its debtors in interests and fees? How can you get an overview of the confusing mass of acts, rules and terms? And what is actually the difference between a reminder fee, a collection fee, expenses of collection, interest etc.?

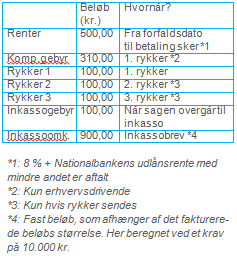

The schedule below provides you with an overview of how, when and how much a company is entitled to claim in interests and the various fees. Please note the comments marked by a star.

*1: 8 % + the reference interest rate of the Danish National Bank (unless otherwise agreed)

*2: May only be collected from merchants acting in the course of their business

*3: Only if a second / a third demand for payment has actually been sent to the debtor.

*4: Fixed fee based on the amount of the invoice (the amount in the schedule is based on a debt of 10,000 DKK).

NB! Please note, that the Danish Interest Act was recently amended with effect from 1 March 2013. Thus, the schedule only concerns debts with a due date after 1 March 2013.

IUNO’s recommendations on internal debt collection procedures

IUNO recommends all companies struggling with bad or late payers once in a while to consider how to act, when a customer does not pay an invoice in due time.

The first thing the company might consider is whether – and if so, when – the claim is to be assigned for external debt collection. Many companies choose to handle the initial demands for payment themselves while letting debt-collection agencies or attorneys be responsible for any further steps.

The second issue to decide is whether the company wishes to send the debtor one, two or three demands for payment. This decision is usually based on a balance of several reasons – e.g. resources of the company, a wish for efficiency, signaling effect towards the customers etc. There is no right or wrong answer; as long as the company makes sure that the final demand for payment contains a notice of debt collection. The attorney of the company might have a template of a demand for payment with / without a debt collection notice for the company to use.

Finally, we advise the companies to create some sort of system reminding when it is time to send the next demand for payment, a debt collection notice, the information letter and so on. This is especially important for companies having several ongoing debt collection procedures at the same time. This can be solved by very complicated means using big fancy computer programs fit for the purpose, or you can choose the lighter version simply putting reminders in your calendar.

Now, the only thing left is to wish you good luck with the debt collection and the establishment of an internal collection procedure of your company.

If you have any questions or are in need of legal assistance, please feel free to contact IUNO any time.

Does this problem sound familiar? If so, it might be a good idea once and for all to get an overview of the rules of debt collection and maybe even to create an effective internal procedure on when and how to react against late payers. Because no one wants to spend too much valuable time and energy on making their customers pay.

Through the legislation on debt collection, the Danish government has tried to compensate for the companies’ extra costs by allowing them to charge various fees and interests during the different steps of the debt collection procedure. However, this most often only brings a minor consolation and the modest-sized fees rarely cover the companies’ actual expenses. On top of this, the legislation consists of a maze of intricate rules for the companies to navigate in; rules that are able to put most people out of breath.

But don’t worry; we have prepared this mini guide to give your company the necessary overview of the Danish legislation on debt collection, and thus providing you with the tools to either determine a new internal procedure on debt collection or perhaps amending the existing procedure.

Debt collection – step by step

Before deciding on the procedure best fit for your particular company, it is important to know the rules on debt collection. The procedure of debt collection may be launched as soon as the company realizes that a debtor (often a customer) has not paid an invoice by the time the deadline expires. A collection procedure usually follows these three main steps:

- When the deadline of payment has expired, the company must send one, two or three demands for payment; the last demand including a notice of debt collection

- The company must send an information letter stating that the claim has now been assigned to debt collection

- Finally, a simplified legal action can be instituted

All companies decide for themselves how many warnings – i.e. demands for payments – should be sent; one, two or three. In the end, this is a question of how long a leash the company wishes to give the debtor. However, there are two conditions that needs to be followed: a) There has to be at least 10 days between demands for payment, and b) the final demand must contain a notice of debt collection letting the debtor know that if payment has not taken place 10 days after the date of the notice, the debt will be assigned to an actual debt collection procedure.

At this point the company has the right to start the actual debt collection. The company is obliged to inform the debtor that such assignment has taken place, and the debtor must be given a warning that legal action might be instituted if the full amount is not paid within an additional given period of time of at least 10 days.

If the debtor has still not paid by the time the additional deadline expires the enforcement court may be involved.

When a company asks for the assistance of the enforcement court it submits a so-called small money claim form. The form can be found at www.domstol.dk – Selvbetjening – Blanketter – inkasso – Betalingspåkrav.

With an efficient collection procedure, the form can usually be submitted to the court 50-60 days after the original time of payment.

It is for the companies themselves to determine, whether the debt collection should be assigned for external debt collection performed by an attorney or a debt-collection agency or, whether the company prefers to handle the collection in-house. Many companies choose a combination; they handle the demands for payment themselves but leave the actual debt collection to an external adviser.

Fees and interests

Okay, so far so good. But how much is a company entitled to charge its debtors in interests and fees? How can you get an overview of the confusing mass of acts, rules and terms? And what is actually the difference between a reminder fee, a collection fee, expenses of collection, interest etc.?

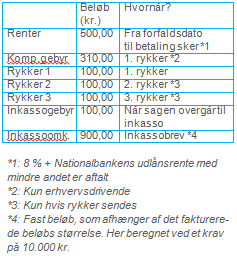

The schedule below provides you with an overview of how, when and how much a company is entitled to claim in interests and the various fees. Please note the comments marked by a star.

*1: 8 % + the reference interest rate of the Danish National Bank (unless otherwise agreed)

*2: May only be collected from merchants acting in the course of their business

*3: Only if a second / a third demand for payment has actually been sent to the debtor.

*4: Fixed fee based on the amount of the invoice (the amount in the schedule is based on a debt of 10,000 DKK).

NB! Please note, that the Danish Interest Act was recently amended with effect from 1 March 2013. Thus, the schedule only concerns debts with a due date after 1 March 2013.

IUNO’s recommendations on internal debt collection procedures

IUNO recommends all companies struggling with bad or late payers once in a while to consider how to act, when a customer does not pay an invoice in due time.

The first thing the company might consider is whether – and if so, when – the claim is to be assigned for external debt collection. Many companies choose to handle the initial demands for payment themselves while letting debt-collection agencies or attorneys be responsible for any further steps.

The second issue to decide is whether the company wishes to send the debtor one, two or three demands for payment. This decision is usually based on a balance of several reasons – e.g. resources of the company, a wish for efficiency, signaling effect towards the customers etc. There is no right or wrong answer; as long as the company makes sure that the final demand for payment contains a notice of debt collection. The attorney of the company might have a template of a demand for payment with / without a debt collection notice for the company to use.

Finally, we advise the companies to create some sort of system reminding when it is time to send the next demand for payment, a debt collection notice, the information letter and so on. This is especially important for companies having several ongoing debt collection procedures at the same time. This can be solved by very complicated means using big fancy computer programs fit for the purpose, or you can choose the lighter version simply putting reminders in your calendar.

Now, the only thing left is to wish you good luck with the debt collection and the establishment of an internal collection procedure of your company.

If you have any questions or are in need of legal assistance, please feel free to contact IUNO any time.

Receive our newsletter

Aage

Krogh

PartnerSimilar

The team

Aage

Krogh

Partner

Aurora

Maria Thunes Truyen

Associate

Emilie

Ulrich Krogh

Junior legal assistant

Frida

Assarson

Associate

Josephine

Gerner Amaloo

Legal assistant

Karoline

Skak Kristensen

Legal assistant

Maria

Kjærsgaard Juhl

Associate